Mutual funds are a frequent way for individuals to invest their money in the stock markets. Essentially, they are baskets of securities, such as stocks and bonds, that are managed by professional portfolio strategists. By investing in a mutual fund, you receive opportunity to a varied portfolio of assets without having to purchase each security individually.

- One benefit of mutual funds is asset allocation, which can help reduce your overall exposure.

- Furthermore benefit is that mutual funds are relatively easy to purchase, as they are traded on major stock exchanges and through many financial institutions.

- On the other hand, it's important to understand different mutual funds before contributing.

Factors to think about include the fund's strategies, costs, and past performance. By thoroughly assessing these factors, you can choose mutual funds that align your objectives and risk tolerance.

Diversifying Your Portfolio with Mutual Funds

Looking to reduce risk and potentially enhance your investment returns? A proven strategy is {diversification|, which involves spreading your money across various asset classes. One effective way to achieve this is through mutual funds. Mutual funds pool money from multiple investors to invest in a basket of securities, such as stocks, bonds, and other assets. This allows you to gain exposure to a wider range of investments with a single purchase, thus broadening your portfolio.

- Investing in different types of mutual funds can help you manage risk. For example, contributing in both equity and fixed-income funds can smooth out your portfolio's performance.

- Provide professional management, which can be particularly helpful if you lack the time or expertise to research and manage individual investments.

- Consider your investment goals and risk tolerance when choosing mutual funds.

By expanding your portfolio with mutual funds, you can take a strategic approach to achieving here your financial objectives.

Comprehending Mutual Fund Fees and Expenses

Mutual funds offer a convenient way to invest your money, but it's crucial to grasp the associated fees and expenses. These costs can significantly impact your overall returns. Typically, mutual funds charge several types of fees, including an expense ratio, which covers the fund's operating costs, and sales charges, also known as load fees, which may apply when you acquire or sell shares. It's important to carefully review a fund's prospectus to establish the specific fees and expenses involved before making an investment decision.

A good rule of thumb is to opt for funds with lower expense ratios, as these can have a significant impact on your long-term returns. Additionally, be aware of any other potential fees, such as redemption fees or early withdrawal penalties. By investing the time to understand mutual fund fees and expenses, you can make more intelligent investment choices and increase your chances of success.

Comparing Different Types of Mutual Funds

The world of mutual funds can seem overwhelming with its vast array of choices. Each type of fund seeks to achieve different objectives, so understanding the differences between them is crucial for any investor.

Typically, mutual funds are classified based on their investment strategies. Some common categories include equity funds, which mostly invest in company stocks; bond funds, which focus on bonds issued by governments; and balanced funds, which spread their investments across both equities and bonds.

Investors should carefully evaluate their own risk tolerance before choosing a mutual fund. It's also important to investigate the fund's past track record and expense ratio to ensure it aligns with your needs. A qualified financial advisor can provide valuable guidance in understanding the complex world of mutual funds.

Choosing the Right Mutual Funds for Your Goals

Mutual funds can be a valuable tool to attain your financial objectives. However, with so many different types of funds available, it can be challenging to determine the right ones for your personal needs.

Before you put your money, take some time to meticulously evaluate your financial goals. Will you be building for retirement, a down contribution on a property, or another entirely?

Once you have a clear understanding of your targets, you can start to explore different types of mutual funds. Consider to the fund's approach and its past performance.

Remember, it's essential to allocate across assets your portfolio by putting money in a variety of funds. A well- balanced portfolio can help minimize your overall vulnerability.

Finally, don't be afraid to talk to a financial planner. They can offer personalized suggestions based on your unique circumstances.

Investing with Mutual Funds for Retirement

Planning for retirement is a crucial step in ensuring financial security during your golden years. Mutual funds/Investment vehicles/Portfolio diversification tools play a vital role/part/function in this process by offering a range/variety/selection of professionally managed investments that can help you grow/accumulate/build wealth over time. With their diversification benefits/risk management strategies/potential for long-term returns, mutual funds allow investors to participate/invest/engage in the stock market and other asset classes efficiently/effectively/strategically. By allocating/distributing/diverting your investments across different/various/multiple sectors and industries, mutual funds can help mitigate/reduce/minimize risk while seeking/targeting/aiming for potential growth.

Furthermore, mutual funds provide flexibility/adaptability/versatility in terms of investment amounts/initial contributions/capital outlay. They are accessible/available/obtainable to investors with varying/diverse/different financial situations and goals. Consult/Speak/Discuss with a qualified financial advisor to determine the best mutual fund options/investment strategies/portfolio allocation that align with your retirement planning objectives/financial aspirations/long-term vision.

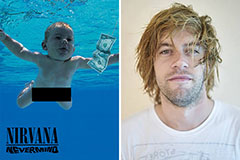

Spencer Elden Then & Now!

Spencer Elden Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now!